This takeaway piece focuses on the implications of this research for platform business models and partnering fintechs. Are you in the right place? If you are more interested in understanding how this research can help development institutions (donors, foundations, etc.) and thinking about where and how to intervene to nudge, coax, and shape the platform era to work best for micro-entrepreneurs, we recommend you have a look here. If you’d rather read about how our project advances theory and research around “MSEs and ICTs”, look here. But, if you think you’re in the right place, please read on!

Introduction

Insights from our research revealed both the opportunities and challenges a micro-entrepreneur faces in trying to generate business over digital platforms. Some of these challenges are manifested through design limitations. In this section, we offer three key takeaways highlighting areas that – through tweaks in design – could be leveraged as vectors of change resulting in positive impacts for micro-enterpreneurs, platforms and partnering fintechs

On this page we offer three key takeaways highlighting areas that could be leveraged as vectors of change for economic and financial inclusion among microentrepreneurs in the digital era:

- Credibility: Buyers and sellers across many platforms could benefit from a better way to assess each other’s credibility when doing business

- Transformational Upskilling: Platforms can help microentrepreneurs become better at conducting business online by guiding them through best practices

- Transactions: By integrating payments into messaging applications, platforms can consolidate the number of applications used by microentrepreneurs and inject the necessary trust that can alleviate fears from both parties

Takeaways

1. Credibility: Buyers and sellers across many platforms could benefit from a better way to assess each other’s credibility when doing business

Challenge:

When conducting business in person, both the buyer and seller leverage a range of different methods – from word of mouth to rapport building – to determine if they can trust one another. In the digital world, where your exposure and interaction with the other party occurs digitally through a platform, it is substantially more difficult to assess credibility. FIBR’s recent research on MSMEs and Superplatforms in Tanzania found trust to be a constant variable in online selling, either “driving or inhibiting interactions”. Similarly, we recognize building trust and credibility as a challenge across the platforms we researched in Kenya. For example, on online work platforms (such as iWriter, Upwork and Studybay) we heard of account holders selling their highly rated accounts to new users, resulting in questions around the credibility of the rating system.

Existing Approaches:

Platforms are addressing these credibility issue in a number of ways:

- Upwork offer a range of skills tests to their freelancers, enabling them to demonstrate their skills to potential clients. This enables clients to more effectively evaluate the value a freelancer could bring to their project.

- Jumia operates as a trusted intermediary and manages operations, logistics and transactions between the buyer and seller. This approach injects a degree of trust between parties, helping to build confidence in the buying and selling journey.

- Lipasafe is an escrow service for small transactions recently launched in Kenya, and integrated with M-PESA. FIBR’s research recommends them as a potential solution to help build trust and reduce friction in online transactions with small MSME seller.

Design consideration:

- More platforms could operate as the trusted intermediary (similar to Jumia) where, in the case of e-commerce, they manage the distribution of the goods to the user and hold the purchase price of the good in an escrow.

- Additionally, FIBR’s research suggests platforms provide “standardized customer service and protection” to help build trust through returns, exchanges, and refunds.

- More platforms could create a ratings system—similar to the ones ride-sharing platforms such as Uber and Bolt (formerly Taxify) use—but, critically, with more attention to providing instructions on how to score. Having a formalized and standardized rating system would help buyers and sellers evaluate each other so that future parties would be able to properly understand and set expectations in future transactions

2. Transformational Upskilling: Platforms can help micro-entrepreneurs become better at conducting business online by guiding them through best practices

Challenge

As we saw with the 27 micro-entrepreneurs we met, each seemingly had their own unique approach to generating business over platforms. Micro-entrepreneurs discover these approaches via a range of methods, from trial and error to direct platform-led upskilling. We believe, although this requires more research, that we should be encouraging platforms working in Africa to provide more direct training to their users. It’s our hunch that an upskilling model, either run by the platform or through a trusted intermediary, is a powerful way to drive broad-based financial and economic inclusion among microenterprises in Africa. In turn we believe platforms would benefit from accelerated sales through improvements in the quality of goods and services on offer.

Existing approaches:

Some platforms are providing online and offline guidance to micro-entrepreneurs to help them improve their digital businesses. We refer to these active approaches by platforms to upskill their users as “transformational upskilling”. Some example include:

- Periodic text messages sent to drivers on the Bolt (previously Taxify) ride-hailing app guides their drivers as to where they should go to maximize earnings (see image)

- Offline training conducted by employees of the platform help coach microentrepreneurs through consultative tactics to improve their business. For example Jumia Kenya provides offline training to all their vendors for free.

Design Considerations

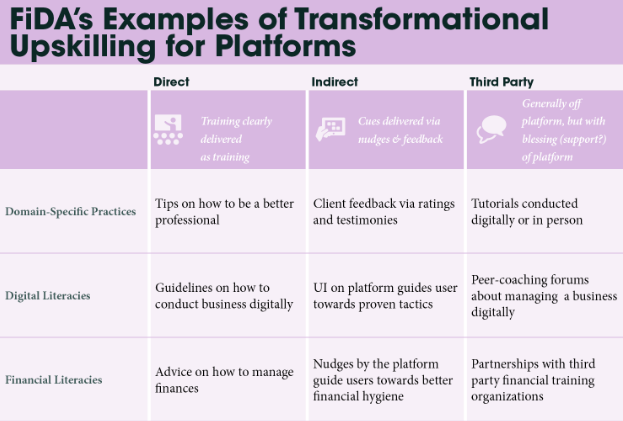

The below table provides a menu of upskilling opportunities. Platform players will have to do their own research to best match these possibile upskilling opportunities to the needs of their specific users.

Design considerations:

3. Transactions: By integrating payments into social messaging applications, platforms can consolidate the number of applications used by micro-entrepreneurs and inject the necessary trust that can alleviate fears from both parties

Challenge:

A significant number of micro-entrepreneurs we spoke to use a sequence of different applications (often including a social messaging app) to promote their products, build rapport with a customer, facilitate delivery, and close a transaction. For example Dorcas, a baker, starts with lead generation through Facebook, moves to rapport-building over a combination of Messenger, Whatsapp, and phone; distributes her products through Uber; and accepts payment over M-PESA.

While end-to-end applications are available—and although as highlighted by i2i’s research at least 70% of African platforms offer a card option for consumer payments—the use of platforms with an integrated payment mechanism appears to be the exception rather than the rule among micro-entrepreneurs. In Kenya, this is likely influenced by the fact that the most popular platforms used by the micro-entrepreneurs are Facebook and WhatsApp.

There is an opportunity for messaging applications to differentiate from the competition by adding, or integrating, a transaction component to their applications. This would not only minimize the number of applications the micro-entrepreneur needs to cycle through for a given transaction but could inject more trust into an online system.

Existing Approaches (and rumours!):

Some of the leading messaging apps are already integrating their own payment applications, or are rumoured to be thinking about it:

- Since May 2018, Whatsapp have been trialing payments in India

- Facebook are also rumoured to be developing their own cryptocurrency

- South Korean social messaging giant Kakao integrated payments into their KakaoTalk service in 2014, and has since expanded into other financial services since launching a digital bank last year

Other smaller FinTechs have built products within these messaging apps to help close this transaction facilitation gap, for example:

- Nigerian Kudi (https://kudi.ai) launched in January 2017, facilitates payments through messaging channels. Kudi helps customers buy airtime, pay bills and send money to friends and family via messaging applications like Facebook Messenger, Telegram, Skype and Web chat.

- In Nigeria, online lending fintech OneFi has recently acquired payments company Amplify, and plans to offer payment options for clients on social media apps including WhatsApp.

Design considerations:

Echoing i2i, the crux of the design challenge is that platforms need to step up to match the cash management needs and behaviors of micro-entrepreneurs on the one hand, and the needs and behaviors of would-be buyers on the other. Our research is one more indication that design efforts to help platforms facilitate transactions, in the forms that match everyday life, is an ongoing design (and ecosystem) challenge. Each platform might want to investigate and prioritize what makes the most sense for the type of transactions it hosts. Below we have provided two examples of current efforts to expand mobile money transaction support to platforms, but reiterate that different approaches will make sense for different business models:

- Integrating USSD mobile payments into mobile apps is hard, often resulting in the transaction window opening up in a separate window, and/or resulting in users having to key in hard-to-remember text strings. Hover helps overcome these issue through its software development kit (SDK) for Android, which enables developers to initiate USSD commands, read responses, and auto-fill inputs in the background of any application running Android 4.3 or above. With the use of Hover’s SDK, mobile money can be integrated into any Android application. This enables app developers to enable their users – buyers and sellers – to access payment mechanisms through the app.

- In markets where mobile money has transformed the payments landscape, micro-entrepreneurs could also benefit from what GSMA refers to as the “payments as a platform” model. In this scenario the payment provider is the platform, and by providing plug-and-play access to their mobile money service through APIs, is able to layer additional services and offerings around their initial payments use case. One example is Safaricom’s launch of its social messaging app Bonga – which is currently in the public beta phase – and e-commerce marketplace Masoko

Concluding thoughts

How does this research links to the Mastercard Foundation’s ‘Young Africa Work’ strategy? The Mastercard Foundation are in the early stages of trying to understand broader technology and business trends, specifically around job creation for youth in Africa.

While the focus of our research wasn’t specifically focused on youth, with a young and fast-growing population in Kenya, it is inevitable that many Kenyan micro-entrepreneurs are young men and women looking for ways to generate a sustainable income. As platforms transform markets around the world this presents new opportunities, and challenges, for young micro-entrepreneurs’ to find work they see as dignified and fulfilling. We hope that by identifying both the positive and negative ways platforms are changing the future of work, we are contributing to the development of a platform landscape that provides youth in Kenya, and across the African continent, meaningful employment opportunities and avenues for financial and economic inclusion.

Read next: Implications for Development Institutions ⇢